Cannabis has evolved significantly over the past few decades from a primarily untracked, unregulated, gray market industry to one of the most regulated industries in the country. The recent introduction of the adult-use market (in 11 states) has proved to be successful for enforcement and regulatory budgets over the past few years by bringing in new tax revenue.

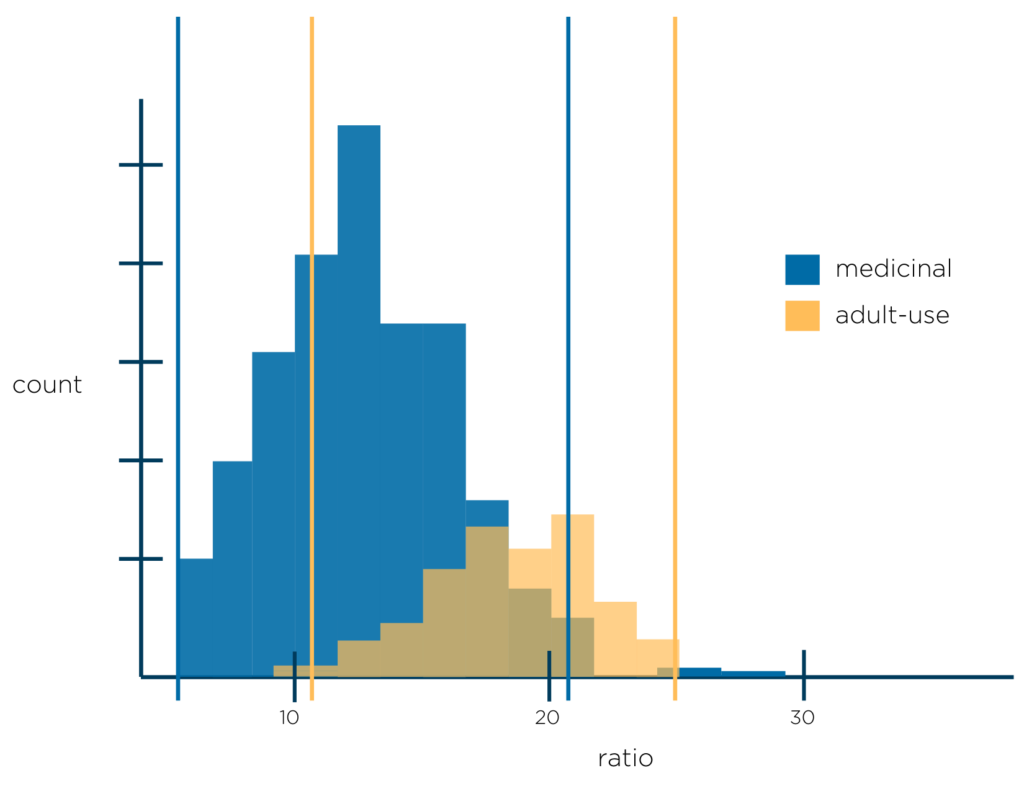

As the adult-use market grew, it created distinctions between it and the medicinal market. When analytics were applied to the data (logically separated by which side of the industry, the activity was occurring), those distinctive characteristics created unique bounds.

If you look at the image below, you can see an example of how wide the differences can be between the two. Gathering all harvest data across an entire market (easily a million harvests have been collected over the last few months) shows trends in things like harvest time, harvest yields, drying efficiency, drying time, products, and amount packaged, or waste.

When we review the alerting category “cure ratio,” a majority of harvests across the medicinal market (blue on the graph) resulted in a cure ratio of around 13%. (Cure ratio is how much moisture was lost from the wet cannabis during the drying and curing process. You can think of the percentage as how much weight is left over after everything.)

As the medicinal and adult-use markets grow and mature the “norms,” and the analytical bounds, will shift. It is important to separate each since they will continue to diverge from one another.