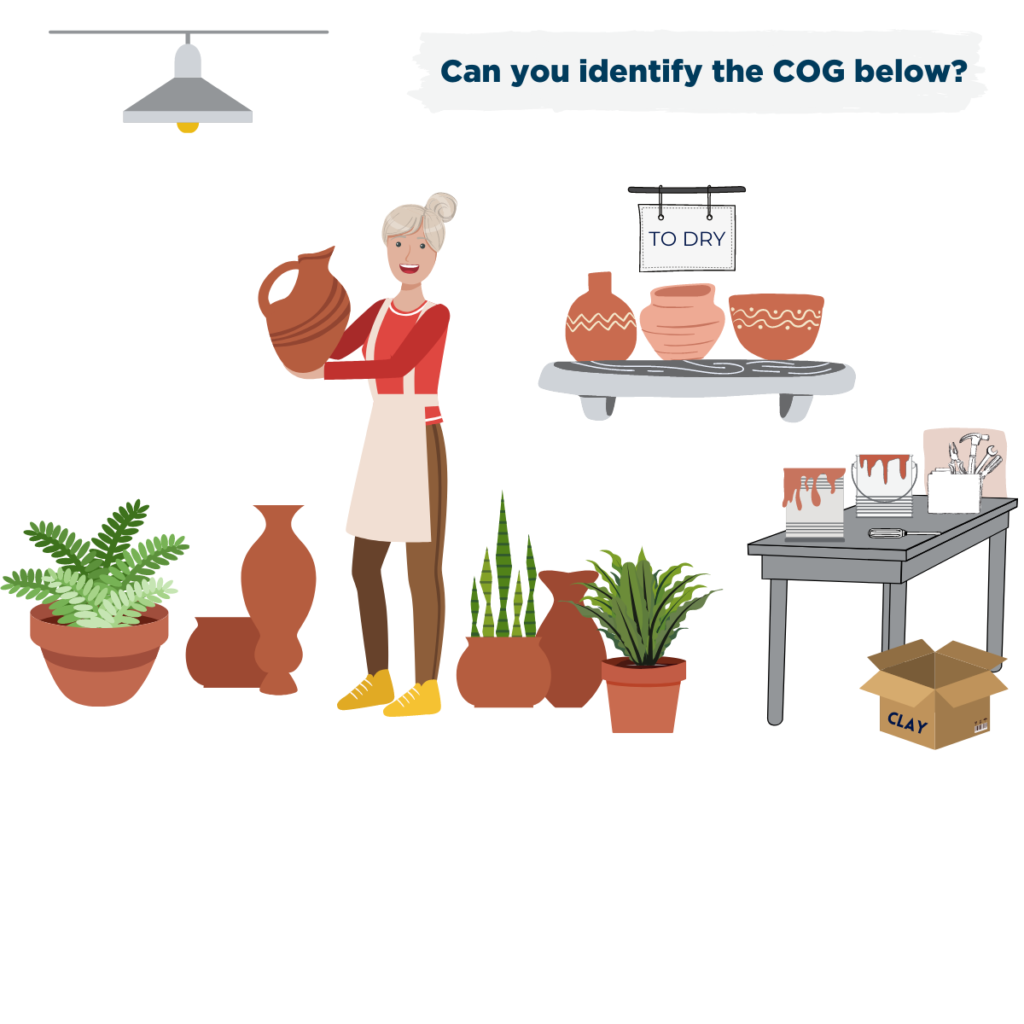

Let’s say I was going to make a simple object like a hand-thrown pot for a plant. You’d need clay, a potter’s wheel, some hand tools, a kiln, glaze, and maybe a rack for storage. You’d also need someone to make the pot, fire the pot, and sell the pot (could be the same person, but for this example, let’s assume separate people). You’d need a studio space and utilities.

Because this pot-making process can’t be done in a day, there is a manufacturing progression. You’ll have some pots in the initial drying phase; some fired once, some fired a second time, some cooling, etc. These unfinished pots are accounted for in what’s called “Work-in-Progress” or WIP for short. Anytime you see WIP on a balance sheet (asset), you know you are in a manufacturing situation, and there is generally a “Cost of Goods Sold,” or COGS for short, on the income statement. COGS offset revenue to create the synonymous “Gross Margin,” “Net Sales,” or “Net Profit.”

Why do I bring this up? The IRS allows for income tax deductions in the “manufacturing” of cannabis as a Cost of Goods Sold. Everything else for a cannabis producer is not deductible. The section of the code is IRS 280E which says you can’t deduct ordinary business expenses associated with controlled substances, but you can deduct direct expenses related to the manufacturing process.

So, in my pottery example, the clay is obviously a direct expense (COG). Utilities, studio space, and equipment are indirect expenses, so not deductible. Employee costs could be partially deductible if you can allocate their expenses between direct and indirect activities.

What you see in cannabis is a lot of effort to allocate expenses to COGS to ease the burden of whatever tax liability is assessed.

As a CPA, please note this blog post is not to be construed as tax advice.